Brussels, 3 October 2024

Written by Guillaume Ragonnaud.

The EU automotive sector has a century-old tradition of producing vehicles with internal combustion engines. It enjoys a global reputation for mechanical engineering excellence, quality, design and creativity. Today, the sector is at a crossroads: the green transition, digitalisation and global competition (in particular China’s emergence as a leading global auto exporter) have fundamentally altered the competitive environment. The sector must adapt its business model quickly to mitigate the risks associated with these disruptive trends.

The EU automotive sector, a historical industrial sector with strong regional ties

The EU automotive industry employs 13.8 million people (directly and indirectly), representing 6.1 % of total EU employment. The industry accounts for 8 % ofEuropeanmanufacturing value added. The EU has 255 automotive plants assembling vehicles and making batteries and engines. It produced 14.8 million vehicles in 2023, including 12.2 million cars, a figure that remains lower than pre-pandemic levels. The EU still has some of the world’s leading carmakers and automotive suppliers, and remains a net exporter of cars.

The sector’s economic relevance differs widely across EU regions and Member States. In Slovakia, Romania, Sweden, Czechia, Hungary and Germany it represents more than 10 % of total manufacturing employment. The automotive sector also has major upstream and downstream linkages and comprises a complex network of cross-border supply chains, including a large number of specialised small and medium-sized enterprises.

The major trends reshaping the automotive industry

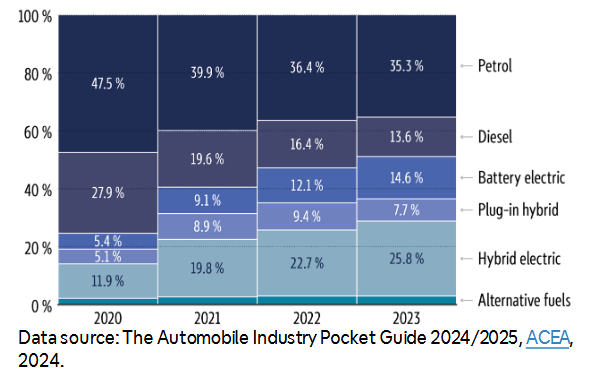

By 2035, all new vehicles in the EU will have to be zero emission (this provision is due to be reviewed in 2026). Electrification has been the key strategy deployed globally by the industry to produce zero tailpipe emission vehicles. Electric vehicles are mainly powered by lithium-ion batteries. In 2023, 14 million electric vehicles were sold worldwide (battery electric vehicles and plug-in hybrid electric vehicles combining a smaller battery with an internal combustion engine – ICE). This figure represents 18 % of all cars sold globally in 2023, up from 14 % in 2022 and 2 % in 2018.

Vehicles are also becoming ever more connected, i.e. able to exchange information with other vehicles and roadside infrastructure. They are also becoming more autonomous (although full autonomy is still far from widespread). In addition, shared mobility (a switch from vehicle ownership to vehicle usership) is expected to become more common. Vehicles are therefore tending to become high-performance ‘computers on wheel‘, increasingly dependent on chips and software.

Can European companies thrive in the new competitive landscape?

These trends have altered the fundamentals of the industry, which has been undergoing the biggest structural transformation in its history. New companies from the battery and tech sectors have entered the market and leapfrogged incumbents, especially as electric cars are simpler to assemble than ICE vehicles.Most European companies are still lagging behind in electric vehicle innovation.European incumbent companies are struggling to make profitable and affordable electric vehicles, particularly due to the high cost of batteries. Only one of the world’s top 15 battery electric vehicles is made in the EU.

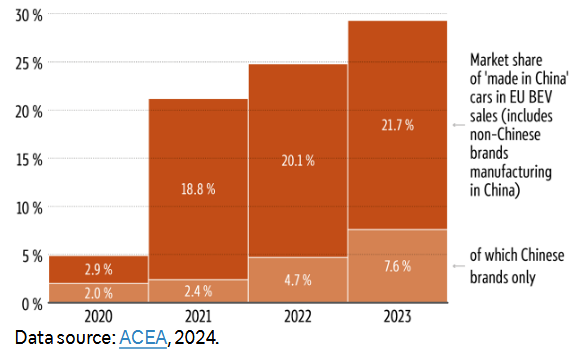

In this context, China has risen as an electric vehicle manufacturing hub. Two trends have emerged. First, Chinese-owned firms are becoming increasingly competitive and exporting more to new markets. Second, China is becoming a manufacturing export hub for multinational companies (Figure 2). Chinese car exports overtook South Korea in 2021 and Germany in 2022, in a context of over-capacity issues on its national market.

China is the main source of car imports for the EU with total EU car imports from the country increasing by nearly 40 % from 2022 to 2023. The country also dominates the production of almost every raw material and component (batteries, chips) used to make EVs. Meanwhile Chinese investment in the EU along the whole EV value chain has been rising for the past few years.

On 4 October 2023, the European Commission initiated anti-subsidy investigations into EU imports of battery electric vehicles from China, on the grounds that these imports were being subsidised and thereby detrimental to the EU industry. Provisional countervailing duties (ranging from 17.4 % to 36.3 % entered into force on 5 July 2024. The definitive measures will be adopted by 30 October unless Member States form a qualified majority against them.

Navigating uncharted waters: A route to greater competitiveness

A range of economic factors have been weighing on the EU sector, such as weak economic growth, high energy costs, disruption in key supply chains, geopolitical risks, and industrial policies of third countries, such as the United States’ Inflation Reduction Act and China’s extensive government interventions.

Over the past few months, job cuts and factory closures have been announced in EU car manufacturing and battery production, fuelled in part by worries about the slowing uptake of electric vehicles in the EU.

Data released in September 2024 concerning EU car registration showed a significant decrease (-18.3 %) compared with August 2023. In particular, registrations of battery-electric cars (BEV), on a downward trajectory, dropped more sharply (-43.9 %) compared to last year. As a result, EU automotive industry representatives are urging the EU institutions to take urgent relief measures and bring forward to 2025 the CO2Regulation reviews for light-duty vehicles.

The recent Draghi Report pointed out that the EU car industry is suffering from higher production costs (overall vehicle productions costs are approximately 30 % higher in the EU compared to China), lagging technological capabilities, supply chain dependencies, and declining brand value. To remain a global leader in the automotive industry, the sector needs to adapt quickly to the new competitive environment.

Draghi recommends measures to lower energy and labour costs, and increase automation in the sector. He recommends developing a specific EU industrial action plan for the automotive industry, covering all stages of the value chain. Furthermore, he advises supporting new important projects of common European interest in very innovative areas (such as affordable electric or autonomous vehicles, and circularity in the value chain), and developing recharging and refuelling infrastructure.

Read this ‘at a glance’ note on ‘The crisis facing the EU’s automotive industry‘ in the Think Tank pages of the European Parliament.