Washington DC, January 29, 2025

On January 24, 2025, the Executive Board of the International Monetary Fund (IMF) concluded the 2024 Article IV consultation[1] with Czech Republic and endorsed the staff appraisal on a lapse-of-time basis without a meeting.

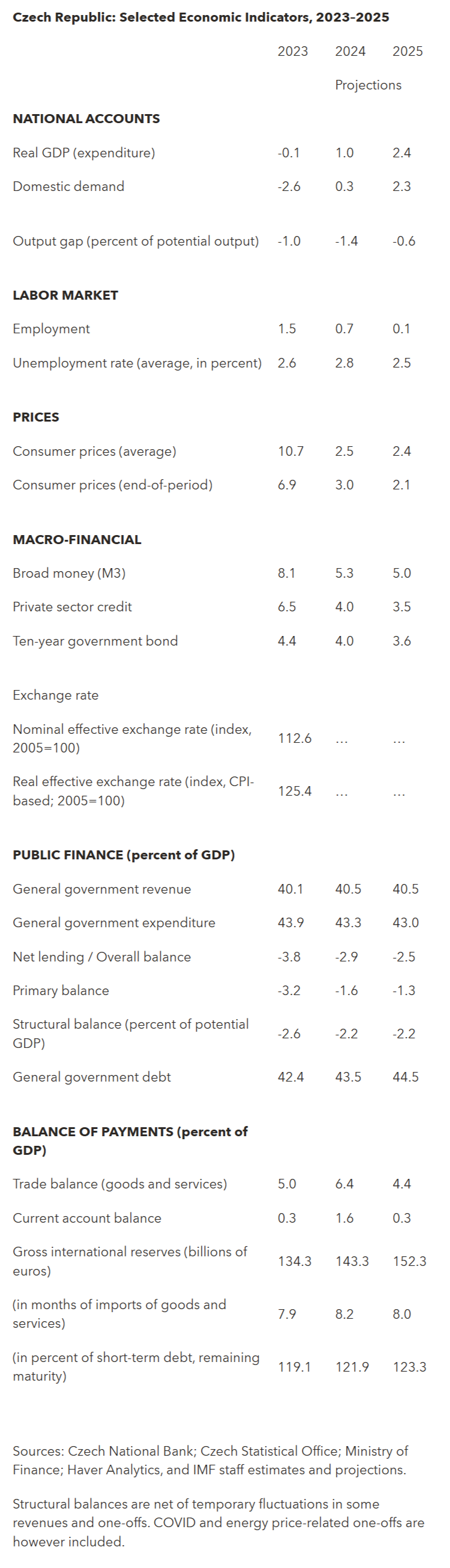

After a period of stagnation, growth has picked up since late 2023, but the recovery has been slow and uneven. Consumer spending has strengthened, sustained by a rebound in real wages and early signs of a decline in the household saving rate. In contrast, investment remains weak, hampered by uncertainty about global trade, the effects of tight domestic policies and a slow absorption of EU funds. Despite subdued economic activity and a decline in job vacancies, the Czech labor market continues to suffer from structural job shortages, particularly among skilled workers, and labor hoarding.

Led by lower commodity prices, restrictive monetary policy, and economic slack, headline inflation has reached the CNB’s 2 percent target and remained close to it over the past summer. It has drifted to 2.8 percent by October 2024, mainly reflecting volatile food prices and administered prices base effects. Core inflation stood at 2.4 percent, as lower goods price growth, was offset by sticky services price growth and recovery in real wages.

Driven by higher real disposable income, growth is expected to have extended its recovery in the second half of the year, but the currently restrictive policy mix and a weak external environment likely dampened near-term outcomes. In 2025, fiscal policy is set to turn neutral, while the need for monetary policy restriction will decrease as inflationary pressures ease. As the policy mix becomes more supportive of economic activity and external demand gradually strengthens, growth should gain further momentum. Wage moderation also supports competitiveness of Czech manufacturers in export markets. As a result, growth is expected to accelerate to 2.4 percent in 2025 from a projected 1 percent a year earlier.

Executive Board Assessment[2]

The Czech economy is slowly recovering after an unprecedented combination of shocks but faces structural headwinds. Following a period of stagnation, growth is picking up, as the policy mix becomes more supportive of economic activity and external demand gradually strengthens. Staff assesses the external position to be moderately stronger than the level implied by fundamentals and desirable policy settings in 2024 (Annex IV). Despite the cyclical upswing, however, weak productivity growth and structural labor shortages are set to weigh down medium-term potential growth, which is now estimated at around 2 percent. Inflation has moderated and, after drifting higher on volatile food prices in the near term, is expected to converge back to target.

Risks to growth are on the downside while risks to inflation appear balanced. Further geoeconomic fragmentation and a weaker than anticipated recovery among key European trading partners, especially Germany, point to downside risks to growth and inflation. On the other hand, stronger wage growth and stickier than expected services inflation, along with protracted increases in commodity prices, could exert upward pressure on inflation.

Staff sees ground for continuing to lower the policy rate. With inflation expectations broadly anchored and output below potential, there is room for additional rate cuts to achieve by mid-2025 a neutral policy rate, which staff estimates at around 3 percent, albeit subject to large uncertainty. Further easing should be pursued in a gradual, data-dependent manner. Once uncertainty recedes and inflation stabilizes more closely to target, the CNB could consider placing more weight on forecast-based inflation targeting.

Consideration should be given to reducing the size of the central bank’s balance sheet over time. Profitability has been considerably improved through various ad hoc cost rationalization measures and diversification towards higher yielding assets. But focus should shift from profit maximization to balance sheet reduction. Aiming to gradually reduce the size of the balance sheet would help limit risks to the CNB’s financial position. To minimize any impact on the exchange rate, this could be done through a transparent and predictable mechanism of small, regular FX sales above and beyond the existing program.

A broadly neutral fiscal stance this year is appropriate, but additional measures will be needed over the medium term to counter spending pressures. Staff recommends a further adjustment of ½ percentage points of GDP annually over 2027–28 to reach a structural deficit of less than 1 percent of GDP by 2028. Productivity-enhancing spending should be safeguarded, and automatic stabilizers should operate freely.

Policy actions should be considered both on the revenue and the spending side. Staff encourages the authorities to reassess the composition of tax revenue. On the spending side, the reform of the Czech pension system is welcome, but further adjustments may be required in the future. Containing the expansion of the public sector workforce, including in fragmented local administrations, and improving targeting of social benefit can limit costs, while efficient absorption of EU funds could boost productivity.

Financial stability risks are contained and broadly unchanged since the last Article IV Consultation but warrant vigilance. Real estate risks should continue to be monitored closely. Given the relatively low risk weights on mortgage loans, supervisors should continue to review bank exposures and ensure that credit risks are accurately reflected in banks’ risk weights. The authorities should also continue to regularly evaluate the effect of mark-to-market losses on banks’ securities portfolios and the impact of exchange rate fluctuations on their corporate exposures. Finally, continued efforts are needed to reduce the transnational aspects of corruption and to safeguard the financial and real-estate sectors from money laundering risks and cross-border illicit financial flows.

Staff assesses the current macroprudential stance as appropriate. Caution should be exerted in considering additional easing. A further release of the CCyB would be advisable only in response to clear materialization of financial risks. Conversely, an increase in the CCyB rate should be considered in case of rapid credit growth and rising asset prices.

Swift action is needed to support the ongoing economic transformation. Building on the newly adopted Economic Strategy, the authorities are urged to undertake concrete policy measures. Structural policies should focus on facilitating the allocation of labor towards higher value-added sectors and firms, addressing the gender pay gap to boost labor participation, reducing administrative burden and red tape, accelerating digitalization, and promoting a more ambitious green transition.

[1] Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2] The Executive Board takes decisions under its lapse-of-time procedure when the Board agrees that a proposal can be considered without convening formal discussions.

Further links

- Country Report No. 2025/036 : Czech Republic: Selected Issues

- Country Report No. 2025/035 : Czech Republic: 2024 Article IV Consultation-Press Release; and Staff Report

Source – IMF