The European Union is increasingly concerned about strategic dependencies on Chinese technology (1). Central to this discussion, and closely linked to the geopolitical rivalry between the United States and the People’s Republic of China (PRC), are semiconductors.

This competition over semiconductors is entering a second phase: in the first phase, export controls considerably restricted Chinese access to and ability to develop advanced semiconductors, particularly those needed for Artificial Intelligence accelerators. The second phase focuses on mature node semiconductors, also known as ‘legacy chips’ (2). These chips are technologically inferior but no less critical. Legacy chips are widely used across a range of industries including automotive, medical devices, drones, robotics, aerospace and defence to name just a few. In the coming years, legacy chips will continue to account for around three quarters of global semiconductor demand (3). Legacy chip shortages during the pandemic highlighted how the scarcity of even a single chip can disrupt entire manufacturing lines.

In contrast to advanced semiconductors, China already possesses the technological capability to produce legacy chips and holds around 30% global market share (compared to the EU’s 13%) (4). Hence, export controls are not as effective in hindering China as they were in the first phase of the semiconductor competition. So, how can the European Union effectively de-risk its legacy chip dependencies on China?

Click here for an interactive Commentary on the same topic.

The nature of the risk?

The EU’s growing dependency on Chinese legacy chips may be considered in terms of two interlinked but distinct risk types:

Overcapacity: Risks resulting from Chinese overcapacities centre on market distortion due to unfair competition and the Chinese party-state’s preferential treatment of domestic companies. When Chinese firms cannot sell subsidised chips on the domestic market or their production facilities are underutilised, they export the excess at artificially low prices, driving out competing suppliers.

Economic security: Risks related to economic security involve critical dependencies on Chinese supply. China could leverage the resultant lack of supply chain resilience for purposes of economic coercion. These new strategic technological dependencies undermine the EU’s attempts to de-risk its economy.

While overcapacity can result in critical dependencies, not all overcapacities pose economic security challenges. Similarly, not all economic security challenges arise from Chinese overcapacity. The distinction between risks stemming from overcapacity and those purely related to economic security is not just academic: policies tackling overcapacity are mostly protective, whereas economic security concerns require diversification to reduce dependencies and their coercive potential. When economic security risks do not stem from overcapacity, expanding supply through diversification becomes essential. In line with the ‘3Ps’ – ‘promote’, ‘protect’ and ‘partner’ – outlined in the EU’s 2023 Economic Security Strategy (5), the focus should shift towards the ‘promote’ and ‘partner’ tools, rather than ‘protect’ measures. See the following Flourish chart:

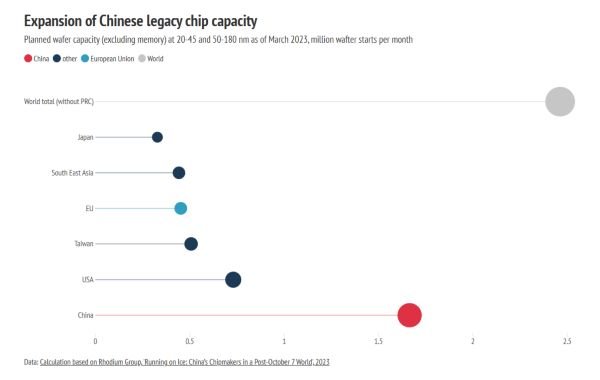

Empirically, China accounts for 40% of the global planned expansion in legacy chip production up until 2030 (see graph in opposite column). (6)At the same time, however, the utilisation of Chinese fabrication facilities (fabs) is approaching the ideal 80% threshold, which is similar to the global average (7). Global demand for legacy chips is increasing dramatically: domestic Chinese demand is particularly strong and a growing share of Chinese legacy chips is sold domestically (8). A low self-sufficiency rate for most legacy chips points to the enormous market potential within the PRC (9).

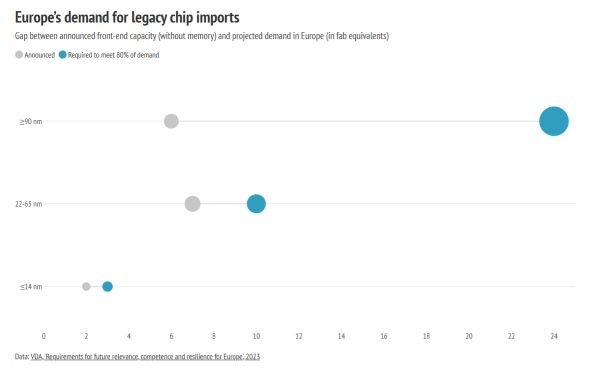

In addition, the expansion of demand is also driven by Europe, which faces an annual supply gap of 12.7 million wafers by 2030. The announced fab buildouts in the EU will only produce 4.5 million wafers per year. Hence, EU companies will need to import at least 8.2 million wafers per year. If the EU aims to close 80% of this local supply gap, it would require enormous additional buildouts. The main supply gap exists in legacy chips. Calculated in fab equivalents, it would need no less than 3 additional fabs with node sizes between 22-65 nm and 18 additional fabs of ≥ 90 nm (see graph below) (10). Such a capacity buildout is unrealistic. See the following Flourish chart:

This raises the question of why European companies are not building out more mature node semiconductor manufacturing capacity. Conventional wisdom holds that profit margins for legacy chips are too narrow to be attractive for European companies (11). The conventional wisdom has some merit. China’s party-state provides both direct and indirect subsidies to its semiconductor industry. For some chip types, the first signs of a price war exist; the high capex-to-sales ratio is only possible due to party-state support.

However, price alone does not fully explain China’s exceptionally rapid growth in this sector. The PRC is not the only country with low labour costs, and profit margins in the legacy chip market are not so low as to assume that it would be unprofitable for European firms (12). The margins, capex, depreciation and overall financial performance levels of leading Chinese chip manufacturers compare well with global industry averages. Hence, it is questionable whether Chinese firms are cutting prices only because of government subsidies. Instead, Chinese firms are benefiting from a trend towards the localisation of production combined with a specific business model in the production of legacy chips.

Localisation: Around 35% of global industry manufacturing capacity is located in the PRC, where there is strong demand for legacy chips. A growing share of Chinese industry is seeking to source legacy chips from local suppliers. This shift towards localisation is the result of a combination of the party-state’s formal and informal political signalling as well as efforts by Chinese industry to enhance its geopolitical resilience. The quality of Chinese legacy chips has also improved.

Business model: China-based additional manufacturing capacity mostly stems from foundries rather than Integrated Device Manufacturers (IDMs). A foundry is a front-end semiconductor fabrication plant that produces chips based on a chip design that is developed by a separate entity. This business model stands in contrast to IDMs that design and produce semiconductors within the same company. Foundries are more flexible in meeting the demand from different market segments, while IDMs primarily meet in- house demand. Hence, foundries can absorb expanding demand more easily and are therefore likelier to expand their capacity. In contrast to Europe (12.8%), China’s legacy chip production capacity buildout is predominantly driven by foundries, accounting for 65.3% (13).

In short, the key factors driving China’s legacy chip production are not just overcapacity or price advantages, but primarily localisation trends and China’s enormous market size for industrial manufacturing. Coupled with a business model that focuses on foundries, these factors provide more opportunities for Chinese legacy chip producers than for their European counterparts. The result is a growing challenge to European economic security.

Exploring economic security risks

The expansion of Chinese legacy chip supply poses a serious threat to the EU’s economic security. However, the extent and speed at which this risk materialises will vary across different types of legacy chips. Legacy chips encompass a wide range of semiconductors, each fulfilling different functions across a broad range of products and sectors. Sales markets differ in their dynamics, and the technical specifications and product characteristics of legacy chips do not equally favour Chinese firms across all sectors. As outlined in more detail elsewhere, five factors are critical for understanding the economic security risks related to: (a) market structure and (b) technological characteristics (14).

These factors include: (1) concentration of supply; (2) geographical origin of demand; (3) likelihood of supply shortages;(4) the potential for technological alternatives to replace the chip (substitutability); and (5) the duration of the product life cycle in which the respective chip is used. Three examples illustrate the varying degrees of risk:

Power MOSFET: Power MOSFET semiconductors handle high power voltages enabling a wide range of applications in consumer electronics, radio-frequency applications, transportation technology, and automotive industries, to name just a few. Chinese firms are poised to dominate global power MOSFET supply, thereby creating a critical dependency. They are expanding their market share and benefit from strong localisation trends in the PRC.

NAND flash memory: NAND flash memory chips are essential for long-term data storage and indispensable to any device that runs software. The outlook for Chinese NAND flash memory producers is similarly strong. While the EU is less affected due to the local absence of memory chip manufacturers and its relatively low consumption of NAND flash memory, it will still suffer indirect impacts. Europe will experience supply chain disruptions as it imports end-products containing NAND flash memory. In the medium term, however, Chinese memory chip suppliers could lose technological competitiveness due to the effects of US export controls.

Microcontrollers: Microcontrollers are tiny computers on a single chip with a broad range of applications such as measuring, sensing and controlling, used in consumer electronics, the automotive industry, energy grids, hospitals, and other sectors. Critical dependencies on Chinese microcontrollers are unlikely to emerge in the near term, primarily due to their low substitutability.

In summary, the risk of major strategic dependencies on China is highest for PowerMOSET and lowest for microcontrollers. While China is likely to gain significant NAND flash memory market share, the EU is less directly impacted. However, US export controls are likely to constrain Chinese growth prospects in the medium term.

Policy implications

The expansion of Chinese firms’ production capacity does not necessarily lead to overcapacity. Chinese firms do benefit from preferential treatment. A further economic slowdown coupled with capital flight could lead to an erosion of China’s electronics manufacturing capacity and potentially result in future overcapacity. While current demand is real and expected to grow, this development is likely to create a critical dependency undermining European economic security. The pace and degree to which economic security will be challenged will vary across different chip types. The ‘protect’ measures that are currently being discussed in the EU are unlikely to be effective. Instead, the EU will need to focus on ‘promote’ and ‘partner’ tools because ‘protect’ measures could reduce supply and drive up prices. To further understand the sourcing of legacy chips, the European Commission has launched a survey seeking input from European industry. It remains to be seen whether the European Commission will receive enough information to conduct a proper assessment differentiating legacy chip types. A more promising approach might be to focus on companies that distribute semiconductors across European economic sectors. Such distributors sell roughly one third of all mature node semiconductors.

To mitigate the economic security risks, the EU needs to differentiate different legacy chip markets. In each critical submarket, it should focus on three policy objectives, each of which could be promoted by two policies:

Maintain European chip suppliers’ market share, including on the Chinese market:

- Policy 1: Oppose local content requirements and localisation practices; as a last resort, threaten to introduce local content requirements on the Single Market.

- Policy 2: Use very narrow, targeted tariffs where market distortions exist and where alternative supply is available.

Promote the diversification and expansion of global legacy chips supply:

- Policy 1: Set up an instrument similar to the International Technology Security and Innovation (ITSI) Fund, making it a central feature of the EU’s chip diplomacy.

- Policy 2: Closely work with EU industry on stress testing geopolitical risks, such as military conflict in the South China Sea or a blockade of Taiwan; underline that gradual investment in resilience is more cost-effective than a hard decoupling.

Invest in the EU’s technological strengths: Uphold reverse dependencies of Chinese companies on EU input by preserving European dominance in key sectors.

- Policy 1: Increase R&D investments and promote innovative business models.

- Policy 2: Intensify collaboration with European industry to better understand intellectual property (IP) theft and support company efforts to enforce their IP rights.

References

- EuropeanCommission,‘SpeechbyPresidentvonderLeyen on EU-China relations to the Mercator Institute for China Studies and the European Policy Centre’, 30 March 2023 (https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_23_2063).

- This Brief adopts the definition of mature node semiconductorsprovidedbytheUSChipsActwhichclassifies legacy chips as those with a 28 nm logic process node or higher, as well as 128-layer NAND in memory.

- Chaio, J. and Chung, E., ‘China’s share in mature process capacity predicted to hit 29% in 2023, climbing to 33% by 2027, says TrendForce’, TrendForce, 18 October 2023 (https://www.trendforce.com/presscenter/news/20231018-11889.html).

- Kleinhans,J.-P.etal,‘Runningonice:China’schipmakers in a post-October 7 world’, Rhodium Group, 4 April 2023 (https://rhg.com/research/running-on-ice/).

- EuropeanCommission,‘AnEUapproachtoenhanceeconomic security’, 19 June 2023 (https://ec.europa.eu/commission/presscorner/detail/en/ip_23_3358).

- ‘Runningonice:China’schipmakersinapost-October7world’,op.cit.

- Goujon,R.etal.,‘Thinice:USpathwaystoregulatingChina- sourcedlegacy chips’,RhodiumGroup,13 May 2024 (https://rhg.com/research/thin-ice-us-pathways-to-regulating-china-sourced-legacy-chips/).

- Ibid.

- Ibid.

- VDA, ‘Semiconductor crisis. Requirements for future relevance, competence and resilience for Europe’, 22 May 2023(https://www.vda.de/en/news/publications/publication/semiconductor-crisis).

- Ebrahimi,A.,‘China’smaturenodeovercapacity:unfounded fears’, Institut français des relations internationales (ifri),8October2024(https://www.ifri.org/en/memos/chinas-mature-node-overcapacity-unfounded-fears).

- Accordingtoindustryinsiders,historically,IDMssuchas Texas Instruments or NXP had profit margins as high as 45-60%. TheTaiwanesefoundryUnitedMicroelectronics Cooperation(聯華電子, UMC)hasmarginsofaround30%.

- ‘Runningonice:China’schipmakersinapost-October7world’,op.cit.

- Rühlig,T.,‘China’slegacychipbuildout:Anewstrategic dependency thatneedsEU de-risking?’,Utrikespolitiska institutet, Stockholm, forthcoming.

Source – EU-ISS