Washington DC, July 16, 2024

Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned three Mexican accountants and four Mexican companies linked, directly or indirectly, to timeshare fraud led by the Cartel de Jalisco Nueva Generacion (CJNG). Concurrently, the Financial Crimes Enforcement Network (FinCEN) issued a Notice, jointly with OFAC and FBI, to financial institutions that provides an overview of timeshare fraud schemes in Mexico associated with CJNG and other Mexico-based transnational criminal organizations.

“Cartel fraudsters run sophisticated teams of professionals who seem perfectly normal on paper or on the phone – but in reality, they’re money launderers expertly trained in scamming U.S. citizens,” said Under Secretary for Terrorism and Financial Intelligence Brian E. Nelson. “Unsolicited calls and emails may seem legitimate, but they’re actually made by cartel-supported criminals. If something seems too good to be true, it probably is. Treasury and our partners are deploying all tools available to disrupt this nefarious activity, which funds things like deadly drug trafficking and human smuggling, and we encourage the public to use our resources to stay vigilant against these threats.”

CJNG, a violent Mexico-based transnational criminal organization, traffics a significant proportion of the illicit fentanyl and other deadly drugs that enter the United States. OFAC coordinated this action with the Government of Mexico, including its financial intelligence unit, Unidad de Inteligencia Financiera (UIF), as well as U.S. Government partners—FinCEN, the Federal Bureau of Investigation (FBI), and the Drug Enforcement Administration.

These transnational criminal organizations operate call centers in Mexico with scammers impersonating U.S.-based third-party timeshare brokers, attorneys, or sales representatives. The scammers target and defraud U.S. owners of timeshares in Mexico through complex and often yearslong telemarketing, impersonation, and advance fee schemes, including timeshare exit, re-rent, and investment scams. Victims of timeshare fraud in Mexico are often targeted again after these scams in re-victimization schemes where perpetrators impersonate U.S.-based law firms and U.S., Mexican, and international authorities. The victims often send payments to the scammers through wire transfers via U.S. correspondent banks to Mexican shell companies with accounts at Mexican banks or brokerage houses (casas de bolsa) before the ill-gotten funds are further laundered in Mexico through additional shell companies and trusts (fideicomisos) controlled by cartel members, their family members, or third-party money launderers, such as complicit accountants and other professionals.

The joint Notice provides the methodologies, financial typologies, and red flag indicators associated with timeshare fraud in Mexico to help financial institutions identify and report suspicious activity to FinCEN and law enforcement. Financial institutions with customers who are victims of timeshare fraud in Mexico are encouraged to file a complaint with federal law enforcement to activate FinCEN’s Rapid Response Program to potentially interdict and recover the fraudulently stolen funds in partnership with Mexico’s UIF.

Origins of CJNG timeshare fraud

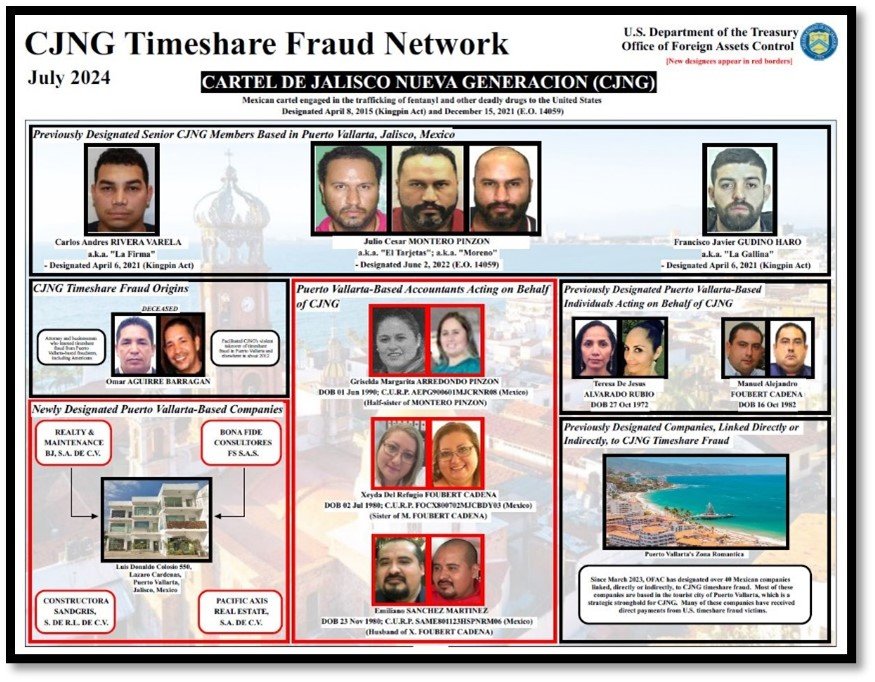

Over a decade ago, Mexican attorney and businessman Omar Aguirre Barragan (Aguirre)—now deceased—learned how to conduct timeshare fraud from Puerto Vallarta-based fraudsters, including Americans. In about 2012, Aguirre educated CJNG about timeshare fraud and sought its support in taking over this highly lucrative scheme from rivals in Puerto Vallarta and elsewhere. Eventually, CJNG took more direct control and cut out Aguirre as an unnecessary middleman.

Exposing and disrupting CJNG timeshare fraud

In 2023, OFAC announced three actions sanctioning a total of 50 individuals and entities linked, directly or indirectly, to CJNG’s timeshare fraud activities. On March 2, 2023, OFAC sanctioned eight Mexican companies pursuant to Executive Order (E.O.) 14059. On April 27, 2023, OFAC sanctioned seven Mexican individuals and 19 Mexican companies pursuant to E.O. 14059. On November 30, 2023, OFAC sanctioned three Mexican individuals and 13 Mexican companies pursuant to E.O. 14059.

Building on the three actions taken in 2023, today OFAC sanctioned additional Mexican individuals and companies pursuant to E.O. 14059 that are linked, directly or indirectly, to CJNG’s timeshare activities. These individuals and entities are located in Puerto Vallarta, Jalisco, Mexico, which is a CJNG strategic stronghold for drug trafficking and various other illicit activities.

Today, OFAC sanctioned Mexican accountants Griselda Margarita Arredondo Pinzon (Arredondo), Xeyda Del Refugio Foubert Cadena (Foubert), and Emiliano Sanchez Martinez (Sanchez) pursuant to E.O. 14059 for being owned, controlled, or directed by, or having acted or purported to act for on behalf of, directly or indirectly, CJNG, a person sanctioned pursuant to E.O. 14059. These Puerto Vallarta-based accountants assist CJNG’s timeshare fraud activities and have familial relationships with previously designated persons. Arredondo is the half-sister of senior CJNG member Julio Cesar Montero Pinzon (a.k.a. “El Tarjetas”), whom OFAC designated pursuant to E.O. 14059 on June 2, 2022. Foubert is Sanchez’s spouse and is the sister of Manuel Alejandro Foubert Cadena, a Mexican attorney linked to CJNG’s timeshare activities whom OFAC designated on November 30, 2023.

Also today, OFAC sanctioned four Mexican companies pursuant to E.O. 14059: Constructora Sandgris, S. de R.L. de C.V.—purported to be engaged in wholesale trade—for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Arredondo, a person sanctioned pursuant to E.O. 14059. Additionally, OFAC sanctioned Pacific Axis Real Estate, S.A. de C.V. and Realty & Maintenance BJ, S.A. de C.V.—purported to be engaged in real estate activities—for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Foubert, a person sanctioned pursuant to E.O. 14059. Finally, OFAC sanctioned Bona Fide Consultores FS S.A.S., an accounting firm, for being owned, controlled, or directed by, or having acted or purported to act for or on behalf of, directly or indirectly, Sanchez, a person sanctioned pursuant to E.O. 14059.

Other actions against CJNG

On April 8, 2015, OFAC sanctioned CJNG pursuant to the Foreign Narcotics Kingpin Designation Act (Kingpin Act) for playing a significant role in international narcotics trafficking. On December 15, 2021, OFAC also designated CJNG pursuant to E.O. 14059. In other actions, OFAC has sanctioned numerous CJNG-linked individuals and companies pursuant to both the Kingpin Act and E.O. 14059 that were engaged in various commercial activities and multiple individuals who played critical roles in CJNG’s drug trafficking, money laundering, and corruption. Many recent actions have focused on CJNG’s strategic stronghold of Puerto Vallarta. OFAC has sanctioned the following senior CJNG members based in Puerto Vallarta: Carlos Andres Rivera Varela (a.k.a. “La Firma”), Francisco Javier Gudino Haro (a.k.a. “La Gallina”), and the aforementioned Julio Cesar Montero Pinzon (a.k.a. “El Tarjetas”). These three individuals are part of a CJNG enforcement group based in Puerto Vallarta that orchestrates assassinations of rivals and politicians using high-powered weaponry.

FBI information on timeshare fraud

According to FBI, approximately 6,000 U.S. victims reported losing nearly $300 million between 2019 and 2023 to timeshare fraud schemes in Mexico; however, this figure likely underestimates total losses, as FBI believes the vast majority of victims do not report the scam due to embarrassment and other reasons. Timeshare fraud scammers may impersonate U.S. or Mexican government authorities, including OFAC.

For more information, please visit FBI’s timeshare fraud resource page or view FBI New York’s public service announcement video featuring a victim of timeshare fraud.

Victims of timeshare fraud are encouraged to file a complaint with FBI’s Internet Crime Complaint Center by visiting https://www.ic3.gov. For elderly victims, financial institutions may also refer their customers to the Department of Justice’s National Elder Fraud Hotline at 833-FRAUD-11 or 833-372-8311.

Sanctions implications

As a result of today’s action, all property and interests in property of the designated persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of designated or otherwise blocked persons. U.S. persons may face civil or criminal penalties for violations of E.O. 14059 and the Kingpin Act. Non-U.S. persons are also prohibited from causing or conspiring to cause U.S. persons to wittingly or unwittingly violate U.S. sanctions, as well as engaging in conduct that evades U.S. sanctions. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. sanctions, including the factors that OFAC generally considers when determining an appropriate response to an apparent violation.

Today’s action is part of a whole-of-government effort to counter the global threat posed by the trafficking of illicit drugs into the United States that is causing the deaths of tens of thousands of Americans annually, as well as countless more non-fatal overdoses. OFAC, in coordination with its U.S. government partners and foreign counterparts, and in support of President Biden’s Unity Agenda, will continue to hold accountable those individuals and businesses involved in the manufacturing and sale of illicit drugs.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the SDN List, but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, please refer to OFAC’s Frequently Asked Question 897. For detailed information on the process to submit a request for removal from an OFAC sanctions list.

More information on the individuals and entities designated today.

View a chart on the entities designated today.