Speech by Fabio Panetta, Member of the Executive Board of the ECB, at the panel on “Cross-border dimensions of non-bank financial intermediation: what are the priorities for building resilience globally?”, as part of the UK G7 Presidency Conference on “Safe Openness in Global Trade and Finance” hosted by the Bank of England

8 October 2021

In the years since the global financial crisis, non-bank financial intermediaries (NBFIs) have shown continuous growth, and now account for more than half of global financial assets.[1]

Although there are a variety of reasons for this development, one of the factors has been the stricter banking regulation adopted after the global financial crisis constraining the risk-taking of banks.[2] The regulatory reforms of the last decade have promoted financial stability, especially in the banking sector.[3] At the same time, these reforms have been accompanied by an expansion of actors outside the regulatory perimeter.

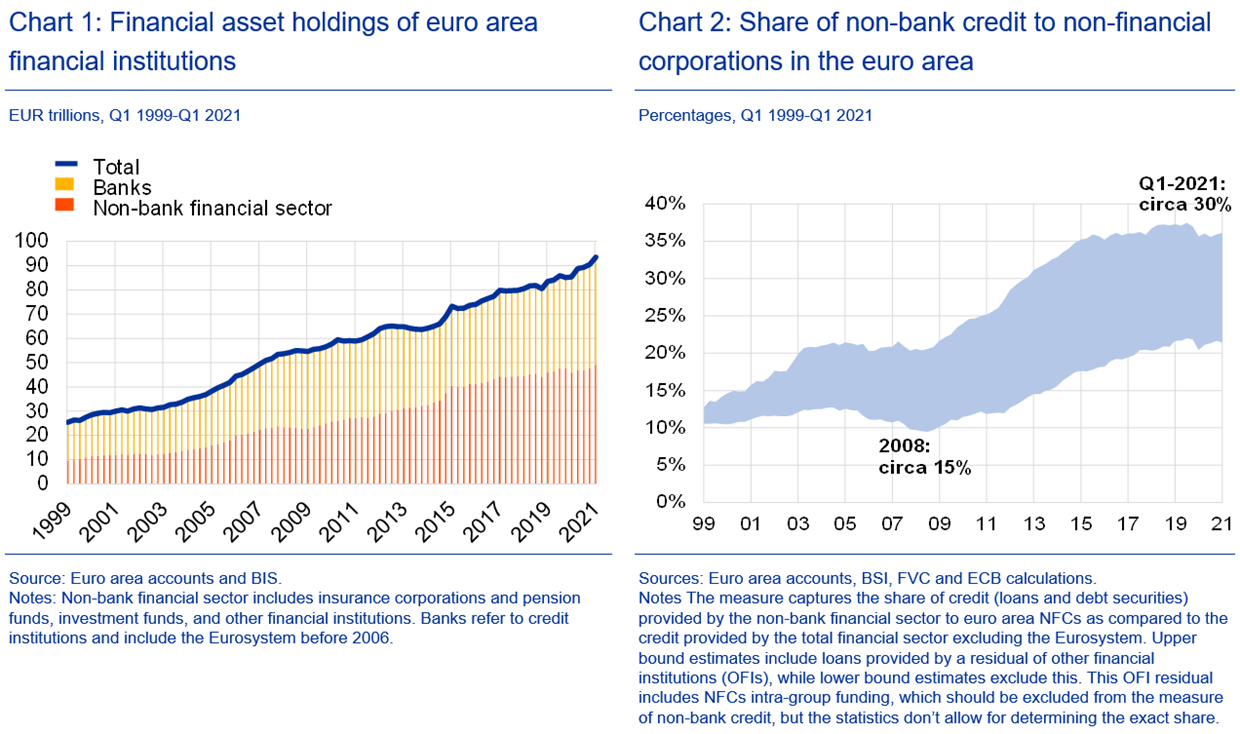

NBFIs have grown faster than banks over much of the past decade: in the euro area, their assets have almost doubled, reaching €48 trillion in December 2020 (Chart 1). In the same period, non-bank finance has become an important source of funding for the real economy: its share of credit to non-financial corporations has increased from about 15% to 30% (Chart 2).

The growth of NBFIs is not the only factor shaping the rapid change of global financial markets. Digitalisation is challenging traditional financial intermediation, for example through the emergence of decentralised finance platforms that are becoming increasingly used. But we can expect more disruptive changes if two related – but up to now parallel – trends eventually converge.

On one side, global technological companies – or “big techs”, such as Google, Amazon, Facebook and Apple (GAFA) – have started offering financial services and, given their size, their large customer base and their access to unique information, are becoming more and more relevant global players in the markets. On the other side, digital assets such as crypto-assets and stablecoins are growing rapidly, although their take-up and reach in payments has remained limited so far. If big techs start issuing global stablecoins, we could see these two trends meet and alter the functioning of global financial markets.

Today, I will argue that if we are to address the cross-border challenges stemming from the expansion of NBFIs, we not only need to strengthen the regulatory and macroprudential approach to these institutions, we also need to widen the regulatory perimeter.

It took the global financial crisis to overhaul the regulation of banks and the coronavirus (COVID-19) crisis to trigger discussions on a more robust framework for money market funds, investment funds and margining practices. We should not wait for another crisis to regulate an increasingly digitalised finance with new global players.