Brussels, 15 February 2024

Following subdued growth last year, the EU economy has entered 2024 on a weaker footing than expected. The European Commission’s Winter Interim Forecast revises growth in both the EU and the euro area down to 0.5% in 2023, from 0.6% projected in the Autumn Forecast, and to 0.9% (from 1.3%) in the EU and 0.8% (from 1.2%) in the euro area in 2024. In 2025, economic activity is still expected to expand by 1.7% in the EU and 1.5% in the euro area.

Inflation is set to slow down faster than projected in the autumn. In the EU, Harmonised Index of Consumer Prices (HICP) inflation is forecast to fall from 6.3% in 2023 to 3.0% in 2024 and 2.5% in 2025. In the euro area, it is expected to decelerate from 5.4% in 2023 to 2.7% in 2024 and to 2.2% in 2025.

Growth to regain traction in 2024 after a weak start to the year

In 2023, growth was held back by the erosion of household purchasing power, strong monetary tightening, the partial withdrawal of fiscal support and falling external demand. After narrowly avoiding a technical recession in the second half of last year, prospects for the EU economy in the first quarter of 2024 remain weak.

However, economic activity is still expected to accelerate gradually this year. As inflation continues to abate, real wage growth and a resilient labour market should support a rebound in consumption. Despite falling profit margins, investment is set to benefit from a gradual easing of credit conditions and the continued implementation of the Recovery and Resilience Facility. In addition, trade with foreign partners is expected to normalise, after a weak performance last year.

The pace of growth is set to stabilise as of the second half of 2024 until end-2025.

A faster-than-expected decline in inflation

The decline in headline inflation in 2023 was faster than expected, largely driven by declining energy prices. With activity stalling, the easing of price pressures in the second half of last year broadened to other goods and services.

Lower-than-expected inflation outturns in recent months, lower energy commodity prices and weaker economic momentum set inflation on a steeper downward path than anticipated in the Autumn Forecast. In the near term, however, the expiry of energy support measures across Member States and higher shipping costs following trade disruptions in the Red Sea are set to exert some upward price pressures, without derailing the process of declining inflation. By the end of the forecast horizon, euro area headline inflation is projected to post just above the ECB target, with EU inflation a notch higher.

Increased uncertainty amid geopolitical tensions

This forecast is surrounded by uncertainty amid protracted geopolitical tensions and the risk of a further broadening of the conflict in the Middle East. The increase in shipping costs in the wake of the Red Sea trade disruptions is expected to have only a marginal impact on inflation. Further disruptions could, however, result in renewed supply bottlenecks that could choke production and push up prices.

Domestically, risks to the baseline projections for growth and inflation are linked to whether consumption, wage growth and profit margins underperform or outperform expectations, and to how high interest rates remain, for how long. Climate risks and the increasing frequency of extreme weather events also continue to pose threats.

Background

The Winter 2024 Economic Forecast provides an update of the Autumn 2023 Economic Forecast, focusing on GDP and inflation developments in all EU Member States.

The Winter Forecast is based on a set of technical assumptions concerning exchange rates, interest rates and commodity prices with a cut-off date of 29 January 2024. For all other incoming data, including assumptions about government policies, this forecast takes into consideration information up until and including 1 February 2024.

The European Commission publishes two comprehensive forecasts (spring and autumn) and two interim forecasts (winter and summer) each year. The interim forecasts cover annual and quarterly GDP and inflation for the current and following year for all Member States, as well as EU and euro area aggregates.

The Commission’s next forecast will be the Spring 2024 Economic Forecast, scheduled to be published in May.

For more information

Full document: Winter 2024 Economic Forecast

Quotes

After a bruising 2023, the European economy has emerged a little weaker than expected, although the rebound should speed up gradually this year and into 2025. Inflation continues its broad-based decline; real wage growth coupled with a resilient labour market should help consumer demand. EU funds, including the RRF, will continue to play a vital role in terms of investments. However, the global landscape remains highly uncertain. We are closely tracking geopolitical tensions, which could have a negative impact on growth and inflation.

The European economy has left behind it an extremely challenging year, in which a confluence of factors severely tested our resilience. The rebound expected in 2024 is set to be more modest than projected three months ago, but to gradually pick up pace on the back of slower price rises, growing real wages and a remarkably strong labour market. Investment is expected to hold up, buoyed by easing credit conditions and the flow of RRF funding. In 2025, growth is set to firm and inflation to decline to close to the ECB’s 2% target. Geopolitical tensions, an ever more unstable climate and a number of crucial elections around the world this year are all factors increasing the uncertainty around this outlook.

Statement by EU Commissioner Gentiloni at the presentation of the Winter 2024 Economic Forecast

Brussels, 15 February 2024

Let me begin with the four key messages emerging from this forecast:

First, the EU economy entered the year on a weaker footing than expected.

Following the strong post-pandemic rebound in 2021 and most of 2022, the latest data confirm that the EU economy barely expanded throughout 2023 – and prospects for the first quarter of 2024 remain muted.

Second, the conditions for a rebound are still in place.

Price pressures have moderated faster than previously expected and energy prices are now substantially lower. As a result, while credit conditions are still tight, markets now expect the loosening cycle to start earlier. And remarkably, the labour market continues to be strong.

Growth in the EU and the euro area is now estimated at 0.5% in 2023, marginally below our autumn projections. EU GDP growth for 2024 is estimated at 0.9%, which is 0.4 percentage points lower than projected in autumn. In 2025, the EU economy is forecast to expand by 1.7%, unchanged from autumn. For the euro area, we project growth of 0.8% this year and 1.5% in 2025.

Third, inflation is expected to continue declining.

Lower energy commodity prices, weaker economic momentum and recent inflation outturns set inflation on a lower path than was anticipated last autumn. Today’s forecast lowers the projections for inflation in the EU this year – to an average of 3.0%, from 3.5% in the Autumn Forecast. For 2025, the projection is at 2.2%, unchanged from autumn. For the euro area, we see inflation averaging 2.7% this year and 2.2% in 2025.

Fourth, the balance of risks is tilted towards more adverse outcomes.

Uncertainty remains exceptionally high, amid protracted geopolitical tensions and the risk of a further broadening of the crisis in the Middle East.

I’ll now outline the main points of our forecast in more detail.

Economic activity in the EU was very subdued throughout 2023, underperforming our Autumn Forecast. This slowdown follows two years of strong post-pandemic expansion and is related to falling purchasing power, collapsing external demand, forceful monetary tightening and the partial withdrawal of fiscal support.

Yesterday’s flash estimate for GDP growth confirmed that both the EU and the euro area narrowly escaped a recession in the fourth quarter of 2023. Our GDP forecast for 2023 also remains valid.

Beyond the short-term weakness, the conditions for a gradual acceleration of economic activity this year are still in place. In particular, a strong labour market, falling inflation and rising wages are set to support a rebound in consumption. The gradual easing of credit conditions, as well as the ongoing deployment of RRF funding, should provide a boost to investment.

Looking at the international picture, global growth (excluding the EU) held up well through 2023. It is expected to weaken from 3.5% in 2023 to 3.3% in 2024 and to return to 3.5% in 2025. The slowdown expected in 2024 is driven by the US and China.

After a strong 2022, the EU underperformed the US in 2023 and is set to do so again this year. Part of the reason for this is that US consumers have benefitted from a larger pandemic stimulus than the EU. Moreover, and this is the main reason, the EU was more negatively affected by Russia’s full-scale invasion of Ukraine and higher energy prices, due to our proximity to the war and higher energy import dependency. However, in 2025, both the EU and US are set to grow by 1.7%. And this is similar to the IMF’s latest World Economic Outlook update.

Global trade growth (excluding the EU) is expected to rebound by 3.5% in 2024 and 3.7% in 2025 after the low growth rates seen in 2023. This is set to provide a modest boost to the EU economy in 2024.

Based on market expectations, this forecast is underpinned by lower energy prices than the Autumn Forecast. Commodity markets have thus far shown little reaction to the tensions in the Middle East.

Crude oil prices have fallen since autumn and are expected to continue gradually declining in 2024 and 2025. The expected slowing of growth in the US and China is weighing on demand, while on the supply side, non-OPEC countries are offsetting attempts by the cartel to tighten the market.

European gas and electricity prices have fallen even more strongly. At the cut-off date of this forecast, futures gas prices based on the TTF benchmark were around 45% in 2024 and 30% in 2025 lower than assumed in autumn, reflecting also very high gas inventory levels and subdued demand.

The ECB has kept its main monetary policy rates unchanged since autumn and dismissed speculation about imminent rate cuts. However, thanks to rapidly falling inflation, markets expect the ECB to start cutting rates sooner and more forcefully than anticipated last autumn. As a result, financial conditions are now somewhat looser than in autumn.

Interest rates have declined across maturities for both sovereigns and corporates. Spreads also narrowed, leading to a broad-based easing of financial conditions for all segments of market funding.

By contrast, bank lending interest rates have not changed much and lending volumes are close to standstill. However, a turnaround in the bank credit cycle seems to be approaching.

In 2023, the EU labour market remained resilient despite stagnating economic activity. Headcount employment continued to expand in the third quarter of 2023, and in December the unemployment rate remained at its record low.

Yesterday’s flash estimate for employment growth confirmed this continued labour market strength. In the fourth quarter of 2023, employment growth picked up: Eurostat’s first estimation for annual growth in 2023 stands at 1.3% in the EU and 1.4% in the euro area. This is even stronger than expected in autumn.

The labour market still looks set to withstand the current weakness in economic activity. So far, weak demand has not translated into a contraction of employment or an increase in the unemployment rate. Some signs of cooling have emerged, such as a weakening of managers’ employment expectations and a decrease in the job vacancy rate. However, both reported labour shortages and the vacancy rate remain at high levels, and do not point to an imminent turnaround on the labour market.

Wage growth has remained robust but has started decelerating. Growth of nominal compensation per employee remained strong in 2023-Q3 but slowed somewhat compared to the quarter before. The deceleration was broad-based across sectors and Member States.

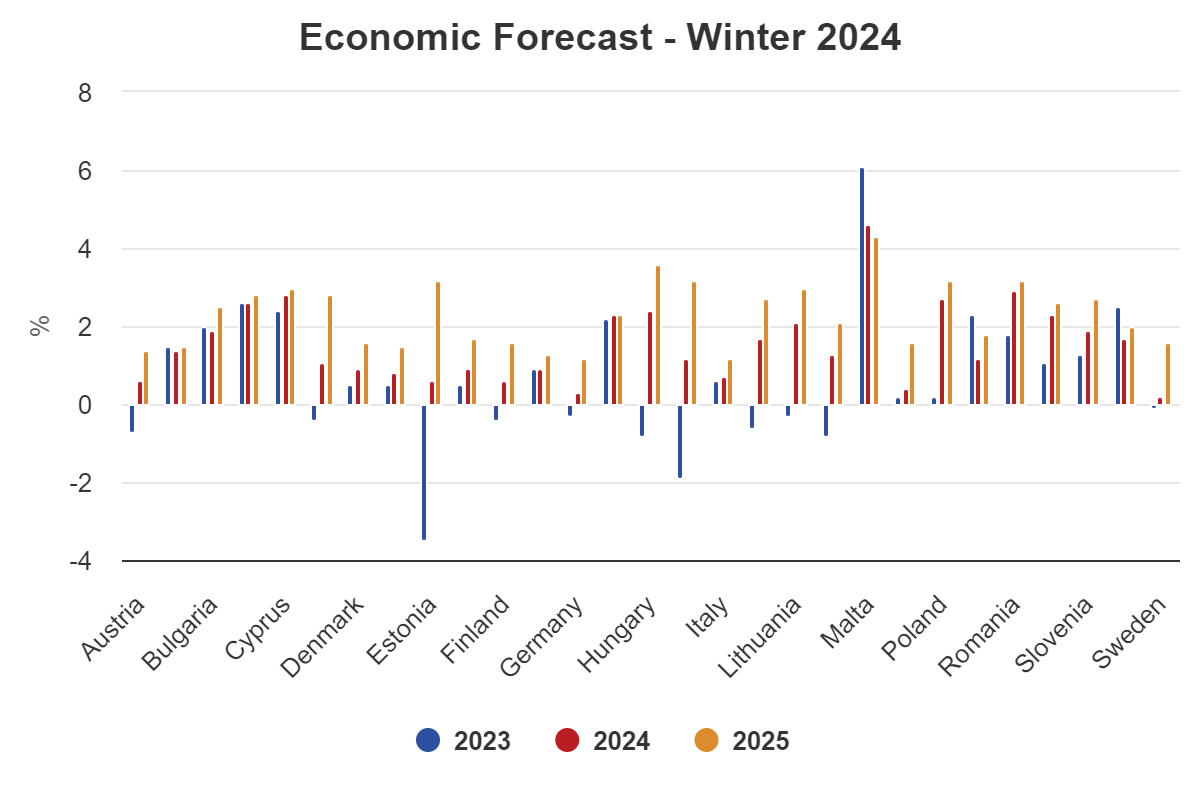

GDP is expected to have contracted in 11 Member States in 2023, especially in central Europe, the Baltic and Nordic countries. The forecast for most of the larger Member States has been revised down for 2024. Still, all EU economies are projected to expand this year and to grow at a stronger pace in 2025.

Economic activity in Germany is estimated to have declined by 0.3% in 2023. Private consumption suffered from a loss in purchasing power. Activity in the construction and energy intensive sectors was restrained by strong cost increases and labour shortages. Overall, real GDP is expected to increase by 0.3% in 2024, a significant downward revision from the 0.8% projected last autumn. In 2025, economic activity is set to expand by 1.2% as the robust labour market and rising real wages support private consumption.

In France, GDP is estimated to have grown by 0.9% in 2023, on the back of government support measures and a favourable labour market. GDP is expected to grow by 0.9% (0.3 less than in Autumn) in 2024 and 1.3% in 2025, driven by private consumption, thanks to rising real wages, and by recovering investment.

Italy’s GDP is estimated to have increased by 0.6% in 2023. Economic activity is forecast to expand by 0.7% in 2024 (0.2 less than in Autumn) and to accelerate to 1.2% in 2025. Private consumption is set to benefit from a modest rise in real wages, in a context of relatively low inflation (2.0%). RRP implementation is expected to provide a further boost.

The Spanish economy is estimated to have expanded by 2.5% in 2023, sustained by private consumption and investment. Real GDP growth is forecast to moderate to 1.7% in 2024, owing to the still weak economic situation in main trading partners and to the lingering impact of interest rate hikes. Consumption and investment are set to drive growth on the back of further gains in purchasing power for households and the continued implementation of the RRP. Real GDP growth is set to accelerate again in 2025, to 2.0%.

Growth in the Netherlands is forecast to have slowed down markedly (to 0.2%) in 2023. Real disposable income losses weighed on consumption and export demand was weak. Growth in 2024 is forecast at 0.4%, revised down substantially (0.7 percentage points) compared to autumn, mainly due to weaker quarterly data in 2023. Private consumption is set to gradually pick up in 2024, as led by strong wage growth, and to recover further in 2025, supporting the pick-up in growth to 1.6%.

In Poland, growth is estimated to have slowed markedly to 0.2% in 2023, on the back of contracting private consumption. In 2024 and 2025, growth is projected to accelerate to 2.7% and 3.2%, respectively. Private consumption is set to be the main growth driver as real wages increase. Robust public consumption and investment are also expected to support the expansion.

Inflation in the fourth quarter of 2023 declined faster than we expected. It averaged 2.7% in the euro area, down significantly from 5.0% in the previous quarter. In January, inflation in the euro area is estimated at 2.8%.

This faster-than-expected easing in inflationary pressures was largely due to cheaper energy commodities. However, tighter monetary policy and the weaker economic momentum also played a role. They helped ease price pressures in services and non-energy goods more than we forecast in the Autumn.

Going forward, we expect inflation to continue moderating, falling to just above 2% by the end of 2025.

Headline inflation in the euro area is set to fall from 5.4% in 2023 to 2.7% in 2024 and 2.2% in 2025.

In the EU, it is projected to decline from 6.3% in 2023 to 3% in 2024 and 2.5% in 2025.

For 2024, this represents a 0.5-percentage-point downward revision with respect to the Autumn Forecast in both euro area and EU.

Our inflation forecast for 2025 remains broadly in line with that in the Autumn Forecast.

While inflation moderation is underway and projected to continue in all Member States, the pace of this reduction differs widely across the EU.

Inflation is set to remain higher in central and eastern European, mostly non-euro area Member States, both this year and the next.

This pattern has characterised our inflation maps since the beginning of the energy crisis. Fortunately, as energy and food prices normalise, and average headline inflation in the EU moderates, so do intra-EU divergences. The dispersion of inflation rates within the EU is projected to decline in 2025 to the lowest since 2016.

Protracted geopolitical tensions tilt the balance of risks towards adverse outcomes. Russia’s ongoing war of aggression against Ukraine remains a key source of uncertainty. The risk of a further broadening of the conflict in the Middle East adds to this uncertainty.

As shipping through the Red Sea has been re-routed, delivery times for shipments between Asia and the EU have increased by 10-15 days and costs have gone up by around 400%.

However, at least so far, neither global nor EU supply chains appear under strain. Higher shipping costs are set to exert a limited upward pressure on inflation in the EU, which is already in our baseline projection.

Further disruptions could, however, result in renewed supply bottlenecks that would depress output and push up prices.

In addition, global policy uncertainty remains high. Surprises in China’s economic growth, to a large extent policy driven, could spill over to the EU and higher for longer policy rates in the US could worsen global financial conditions. Furthermore, 2024 will be a historic election year around the world, adding to policy uncertainty.

Domestically, growth and inflation risks appear broadly balanced.

To sum up, the EU economy entered 2024 on a weaker footing than previously anticipated. The rebound is delayed, but still expected as we look towards 2025. A strong labour market, easing inflation, rising wages, the expected gradual easing of credit conditions as well as the RRF provide a solid foundation for a pickup in economic activity.

The future economic outlook is unfortunately subject to high uncertainty, not least owing to Russia’s ongoing war against Ukraine and the rising tensions in the Middle East.

Yet it is in our power – and it is our responsibility – to support sustained and sustainable growth. The effective implementation of national recovery and resilience plans is a key priority, as is the twin transition towards a green and digital economy. A close coordination between prudent, investment-friendly fiscal and monetary policies should be pursued to support the ongoing efforts to keep inflation at low levels.