Source: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_2908

The European Commission has published today the preliminary report on the initial findings of its ongoing competition sector inquiry into the consumer Internet of Things (IoT) which was launched in July 2020.

The Sector Inquiry forms part of the Commission’s digital strategy and follows an announcement in the Commission’s Communication on Shaping Europe’s digital future. The consumer IoT sector inquiry aims to better understand the consumer IoT sector, its competitive landscape, developing trends and potential competition issues.

For further information, please see the press release. For more background about the Consumer IoT Sector Inquiry and competition sector inquiries in general, please see the sector inquiry’s webpage.

1. What kind of information has the Commission gathered for the preliminary report?

The findings in the Preliminary Report summarise the qualitative information obtained by the Commission from the responses to the sector inquiry.

In July 2020, the Commission sent out different questionnaires to companies active in four consumer IoT segments in the EU:

More than 200 companies responded to one or more questionnaires, with a response rate of over 50%. They also shared with the Commission over 1000 agreements in relation to their consumer IoT activities.

Respondents to the Sector Inquiry are for the most part large corporations, both in terms of number of employees and in terms of turnover. However, the sample also includes SMEs, primarily start-ups or specialised service providers. The participants to the sector inquiry are located across Europe, the US and Asia.

A fifth questionnaire was sent to standard-setting and industry organisations of relevance to consumer IoT, including international standardisation organisations as well as other entities of relevance to consumer IoT, such as private not-for-profit organisations and alliances between undertakings operating in the consumer IoT sector. We received close to 15 replies to this fifth questionnaire.

2. What are the main characteristics of the consumer IoT sector?

The consumer IoT sector has grown rapidly in recent years and is expected to continue to do so in the next decade. Worldwide consumer IoT revenue is predicted to increase from approximately €107.2 billion in 2019 to approximately €408.7 billion by 2030.[1]

The use of consumer IoT products is increasingly becoming part of everyday life for EU citizens. In particular, connected audio and video entertainment devices have become relatively widespread: in 2020, for example, 51% of individuals in the EU reported that they used the internet on a smart TV, games console, home audio system, or smart speaker[2].

Voice assistants are becoming key gateways to smart homes, allowing companies to establish interoperability and to build a smart home environment based on products from different manufacturers. They represent the fastest developing interface for users to access the web, to use and control smart devices and to access consumer IoT services. The number of voice assistants in use worldwide is expected to double between 2020 and 2024, from 4.2 billion to 8.4 billion[3]. Moreover, 11% of EU citizens surveyed in 2020 has already used a voice assistant[4].

The leading providers of voice assistants in the EU are Amazon (Alexa), Google (Google Assistant) and Apple (Siri). Their general-purpose voice assistants enable users to access a broad range of functionalities in response to voice commands, such as playing music, listening to the radio, to news or to podcasts, controlling smart home devices, providing information or helping in planning and executing daily routines.

Despite the growing popularity of voice assistants, the smart mobile application remains to date the most used user interface to access smart devices and consumer IoT services. In that sense, smart mobile devices and their operating systems also play an important role in the consumer IoT sector. Google’s Android and Apple’s iOS are the leading operating systems for smart mobile devices.

3. What are the main features of competition in consumer IoT?

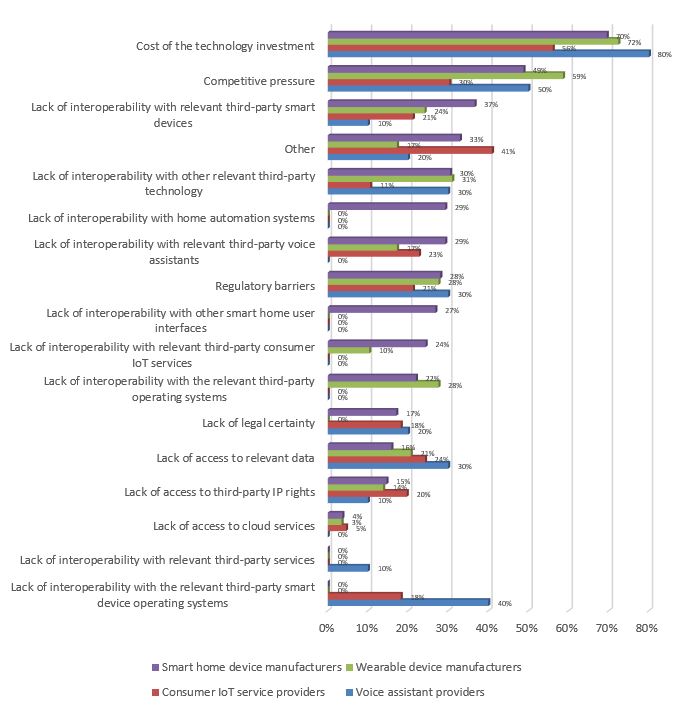

Respondents identified quality and brand reputation as the main parameters of competition in the sector. At the same time, when asked about entry or expansion barriers to developing and launching smart home and wearable devices, consumer IoT services and voice assistants, respondents pointed to the cost of the technology investment and the competitive situation in the sector, as shown in (figure 1)[5]. This is especially true for voice assistants: respondents stressed that the cost of developing and operating general-purpose voice assistants is almost prohibitively high and there is a general belief that there will not be new entrants in the short term.

Figure 1: Barriers to entry or expansion

A large number of respondents pointed out that the main obstacle to developing new products and services is the ability to effectively compete with the leading players in the consumer IoT sector, namely Google, Amazon and Apple. The leading players are also considered to be “must-have” brands for certain products and services (e.g. home automation systems, voice assistants). Furthermore, these vertically integrated players have built their own ecosystems within and beyond the consumer IoT sector by combining their own and third-party products and services into an offering with a large number of users.

Nevertheless, the features of competition vary depending on the product or service concerned. For example, there are only a few alternative voice assistant providers, whereas quite a large number of companies are active in the manufacture of smart devices and the provision of consumer IoT services.

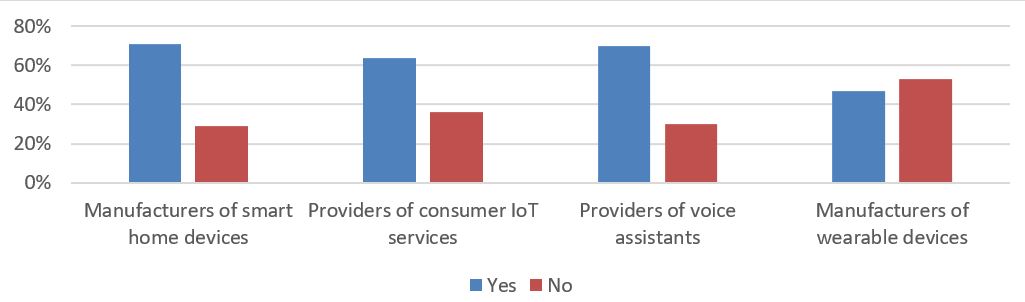

In terms of future expansion within the consumer IoT sector, most respondents indicated that they plan to develop and launch other smart devices and/or to expand their business to other consumer IoT segments in the next three years (figure 2).

Figure 2: Plans to launch new consumer IoT products or services in the following three years (% of total respondents per questionnaire)

4. Which concerns were raised during the sector inquiry?

The Preliminary Report sets out the main potential concerns raised by respondents in relation to the following areas, including:

- Exclusivity and tying concerns in relation to voice assistants, as well as practices limiting the possibility to use different voice assistants on the same smart device.

- Several concerns regarding the role of the leading providers of voice assistants and smart device operating systems as intermediaries between the user and smart devices or consumer IoT services, including their control over the user relationship. In this context, concerns on the pre-installation, default-setting and prominent placement of consumer IoT services on smart devices or in relation to voice assistants were also raised.

- Data, including the access to and accumulation of large amounts of data by voice assistant providers, which allegedly enables them not only to control the data flows and user relationships but also to leverage into adjacent markets.

- Lack of interoperability due to technology fragmentation, lack of common standards and the prevalence of proprietary technology, as well as the control over interoperability and integration processes by a few providers of voice assistants and operating systems.

5. What are the next steps?

A public consultation will now follow the publication of the Preliminary Report. Interested parties will be able to comment on the preliminary findings of the sector inquiry, submit additional information or raise further issues. The public consultation will run for a period of 12 weeks until 1 September.

The final report on the sector Inquiry is expected in the first half of 2022.

The information collected in the context of the sector inquiry on the consumer IoT will eventually provide guidance to the Commission’s future enforcement activity, to ensure respect of EU competition law.

Furthermore, the findings of the sector inquiry may also feed into the regulatory work of the Commission.

[1] Transforma Insights. “Internet of Things (IoT) revenue worldwide from 2019 to 2030 (in billion U.S. dollars), by vertical.” Chart. December 22, 2020. Statista. Accessed March 24, 2021. https://www.statista.com/statistics/1183471/iot-revenue-worldwide-by-vertical/

[2] Eurostat available at https://ec.europa.eu/eurostat/databrowser/view/isoc_iiot_use/default/table?lang=en

[3] Voicebot.ai, und Business Wire. “Number of digital voice assistants in use worldwide from 2019 to 2024 (in billions)*.” Chart. April 28, 2020. Statista. Accessed March 24, 2021. https://www.statista.com/statistics/973815/worldwide-digital-voice-assistant-in-use/

[4] Eurostat available at https://ec.europa.eu/eurostat/databrowser/view/isoc_iiot_use/default/table?lang=en

[5] The figures represent, per consumer IoT segment, the percentage of the respondents to the question that mark a given factor as an existing barrier to entry or expansion.